Billionaires don’t guess when it comes to important decisions. The 3 rules billionaires follow help them stay consistent, focused, and effective under pressure.

They rely on personal frameworks to guide their thinking and actions. These rules prioritize clarity, control, and long-term success. You’ll learn how they think and how you can use the same logic in your own decisions.

Rule 1: Think Long-Term, Not Short-Term

Big-picture thinking is the foundation of lasting success. Billionaires stay future-focused when making decisions.

They See Years Ahead, Not Weeks

Billionaires don’t chase quick wins. They build for the next five to ten years. Every action supports a long-term outcome.

Jeff Bezos planned Amazon’s growth in decades, not quarters. This forward mindset builds stability. It eliminates distractions that waste time.

Urgency Doesn’t Equal Importance

Urgent decisions are often emotional. They resist this trap. They evaluate if the outcome will still matter in five years.

Temporary pressure never drives their actions. They prioritize relevance and impact. This approach removes stress and adds clarity.

They Filter Every Choice Through the Future

Decisions must align with long-term goals. If they don’t, they’re ignored. This keeps efforts focused and consistent.

They review every option’s future value. If something feels good now but fails to scale, they drop it. Discipline is what turns vision into reality.

Rule 2: Use Data, Not Emotion

Smart choices come from evidence, not feelings. Billionaires prioritize logic over instinct.

They Always Look at the Numbers First

Data is their foundation. They collect hard facts before deciding. Billionaires ignore rumors and hype.

They use verified sources to support their actions. This method reduces mistakes. It also builds confidence in the result.

They Avoid Emotionally-Driven Traps

Emotion clouds good judgment. Billionaires like Warren Buffett stay calm under pressure. They trust the data, not their mood.

This approach helps them stay consistent. It also protects them from impulsive losses. Emotional decisions are filtered out fast.

They Let Information Lead the Way

Numbers guide their strategy. They wait until the data supports the move. There’s no rush to act on gut feeling.

Billionaires evaluate multiple sources and look for patterns. They move only when results align with logic. This keeps their success repeatable.

Rule 3: Protect the Downside First

Smart risk management is a habit among billionaires. They act boldly, but never blindly.

They Always Plan for the Worst

Before making any move, they ask what could fail. If the loss is too big, they don’t proceed. Billionaires look for weak spots before investing.

Richard Branson always secures exit options in advance. This keeps failure from becoming fatal. It also lets them move faster with confidence.

They Prefer Small Losses, Big Gains

The goal isn’t to avoid risk but to shape it. Billionaires take asymmetric risks: low downside, high upside. They don’t gamble—they test.

If the risk is capped and the reward is big, they go forward. Every risky decision comes with a protection plan. It’s not luck—it’s setup.

They Use Controlled Experiments

No major move starts without testing. Billionaires test ideas with minimal exposure. If it works, they scale. If it fails, they retreat safely.

This approach lowers fear and increases precision. That’s how they move quickly while staying protected.

How These Rules Work in the Real World?

These decision rules aren’t just theories—they hold up in actual practice. Billionaires use them consistently to stay sharp and in control.

They Help Reduce Stress and Confusion

When you follow a clear rule, you don’t second-guess every move. You cut through doubt quickly. Billionaires use each rule as a filter, so there’s less noise to process.

This speeds up decisions while keeping them smart. Stress drops when the path is structured. You stop guessing and start executing.

They Minimize Decision Fatigue

Too many choices lead to burnout. Billionaires avoid that by automating how they decide. They don’t waste time debating every detail.

Instead, they rely on pre-set rules that remove unnecessary effort. This keeps their minds fresh for the real challenges. Their energy goes where it matters.

They Create a System Anyone Can Use

You don’t need billions to copy the framework. Just use the same structure with your own priorities. Apply it to work, money, or personal life.

Ask what the long-term impact is, what the data says, and how to limit risk. The more you use it, the more natural it gets. That’s how smart habits form.

Mistakes Most People Make – And Billionaires Avoid

Many people struggle with decisions because they lack structure. They rush, overthink, or rely too much on feelings. Billionaires avoid this by using simple but powerful rules every time.

Here are the most common mistakes and how the rules prevent them:

- Emotional Decisions: When you’re angry or excited, you’re more likely to choose poorly. Using data helps cut through emotion and bring focus.

- Acting Too Fast: Quick action isn’t always smart action. Thinking long-term forces you to pause and evaluate consequences.

- Ignoring Risk: Most people assume everything will go right. Protecting the downside ensures you’re ready if it doesn’t.

- Lack of Clarity: Without a clear rule, every decision feels overwhelming. Rules give you a personal system that reduces confusion.

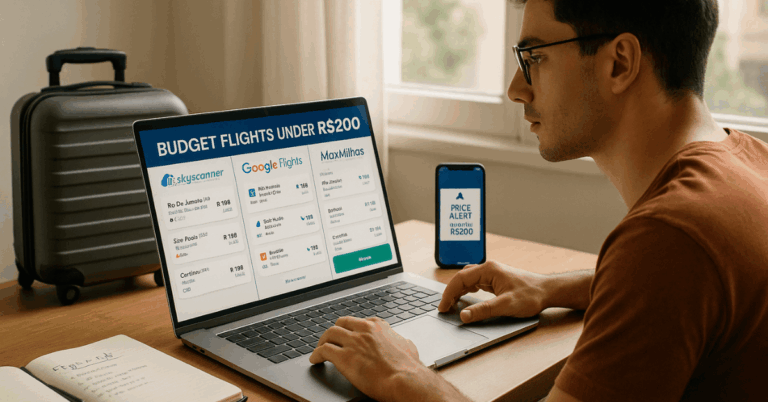

Examples from Billionaires Themselves

You don’t need to guess what works—just look at what top decision-makers actually do. These examples prove the power of each rule:

- Jeff Bezos uses a “regret minimization” framework. He asks, “Will I regret not doing this in 20 years?”

- Warren Buffett avoids emotional trades and only invests based on clear value and safety margins.

- Richard Branson takes bold risks but always secures backup plans to prevent large losses.

- Elon Musk uses first-principles thinking, stripping problems down to their core data before deciding.

These aren’t complicated methods—they’re just practiced habits. The key is to repeat them every time.

Start Using the Rules in Your Own Life

You don’t need wealth to think like a billionaire. These principles work at any level.

Write Your Own Decision Rules

Start by drafting your three personal rules. Make sure each one reflects your values and goals. Keep them short, clear, and memorable.

Use them for major choices in work, money, and relationships. Adapt them as your life evolves. Let them guide you daily.

Track Every Major Choice You Make

Write down key decisions you face. Note how you applied each rule to your process. Track what worked and what didn’t.

Monthly reviews will show clear patterns. This helps refine your thinking. Over time, your judgment sharpens.

Build Confidence Through Control

Rules help reduce second-guessing. They bring structure to unclear moments. With a system, you stop reacting and start choosing.

You gain control over outcomes and emotions. This leads to better performance and fewer regrets. That’s the real value of using decision rules.

Final Takeaway: Apply These 3 Rules Now

Big decisions don’t have to feel risky or random. When you have a system, you gain power and peace of mind.

The 3 rules billionaires follow are not just for the wealthy—they’re for anyone who wants to think better, act smarter, and win long-term. Use them consistently, and your results will improve with every choice you make.