Getting access to local financial products is a common need for foreigners living in Brazil. One smart move is to apply for Mercado Pago credit card to enjoy shopping flexibility and control.

In this guide, you’ll learn the entire application process from eligibility to support. We’ll also break down interest rates, benefits, and what to expect.

Overview of the Mercado Pago Credit Card

Mercado Pago offers a Visa card that functions as both a debit and a credit card. It’s designed for use in physical stores and online platforms within Brazil and internationally.

The card is connected directly to your Mercado Pago account and can be managed entirely through the app. There are no annual fees, and Meli+ users get additional perks.

You can split purchases into up to 18 interest-free installments. Cashback is available for both Meli+ subscribers and regular users who shop on Mercado Livre.

Who Can Apply – Requirements for International Users

Before you begin the process, make sure you meet the basic eligibility criteria. This section outlines the documents and account details that international users must have in place before applying.

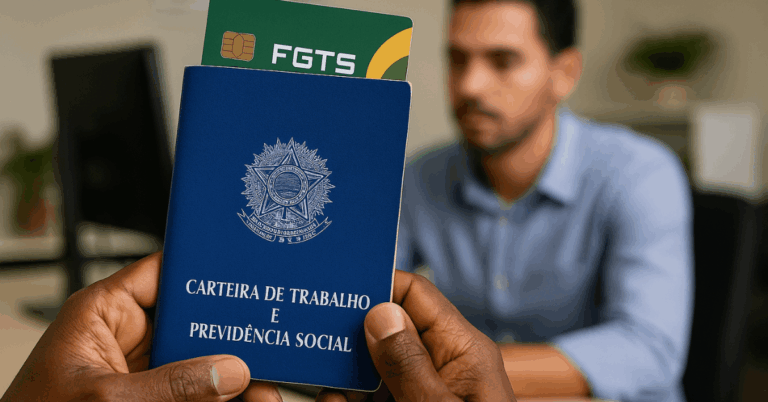

CPF and Local Residency Requirements

To apply for Mercado Pago credit card, international users must meet identification requirements. A Brazilian CPF is mandatory and must be linked to your account.

You also need to provide a valid residential address inside Brazil. Cards will not be shipped internationally.

Mercado Pago Account and Verification

You must create a Mercado Pago account and complete identity verification before submitting your application. This includes confirming your CPF, phone number, and email.

The app uses this data to analyze your credit profile. All documents must be current and valid.

Meli+ and Credit Analysis Benefits

Meli+ subscribers receive higher cashback and better approval chances. Using Mercado Pago services actively also strengthens your application.

Your credit score will still be checked, even if you’re new to the process. Consistent account use builds trust with the system.

Step-by-Step Application Process

The application is fully digital and easy to complete. This section outlines the exact steps to help you move forward with confidence.

- Open the Mercado Pago app and log into your account.

- Tap on the “Cartão de Crédito” option to begin the request.

- Fill in your personal and financial information as required.

- Mercado Pago will review your credit score and identity.

- If approved, the card will be mailed to your registered Brazilian address.

- Activate your card and control spending via the app.

Benefits and Usage

This section highlights the top benefits of using this credit card. You can maximize your savings and control your finances through the app’s features.

- Make purchases in Brazil and internationally with full card flexibility.

- Pay in up to 18 interest-free installments through Mercado Livre.

- Get 5.6% cashback if you are a Meli+ subscriber.

- Receive 0.6% cashback even without Meli+ benefits.

- Use the app to monitor spending, freeze the card, and pay bills.

Accepted at all merchants that support Visa, including for QR code and subscription payments.

Interest Rates and Fees

Understanding the cost of credit helps you avoid unwanted charges. This section breaks down the fees linked to the Mercado Pago credit card.

Monthly and Annual Charges

Although the card has no annual fee, additional charges may still apply. Interest on unpaid balances can reach up to 10.99% monthly.

This results in a high APR if the amount is not paid in full. Avoid carrying balances to stay interest-free.

Foreign Transaction and IOF Tax

Foreign transaction fees follow Visa’s global rate and may include an IOF tax of 6.38%. This applies when using the card outside Brazil or for international services.

Charges can vary depending on how and where the card is used. Always review terms before traveling.

Personalized Interest Rates

Each user gets a custom interest rate based on their credit profile. Mercado Pago may adjust your rate after analyzing your financial behavior.

Review this detail in your app settings. Use the app to track and manage your charges.

Troubleshooting and Customer Support

Some users may face problems during registration or approval. If you’re missing a CPF or cannot verify your address in Brazil, the application will be rejected.

Linking a verified email and Brazilian phone number is essential. Additionally, using an outdated app version may prevent your request from being processed.

It provides multiple support channels for help. Use the in-app support chat for quicker replies. If needed, call 0800-637-7246 within Brazil for assistance.

Address and Delivery Limits for Foreigners

International users can apply, but the card must be shipped within Brazil. If you’re living abroad temporarily, use a trusted address in Brazil.

The delivery takes a few business days after approval. You cannot choose international shipping. It does not issue cards to foreign addresses.

You also cannot register the account under a passport—a valid CPF is required. Proof of residency may be requested in some cases. Make sure your Mercado Pago profile is up to date.

Common Issues and Solutions

Sometimes, applications can fail due to avoidable problems. This section breaks down common reasons and guides how to address them.

Low Credit History and Missing Documents

Some users get rejected due to low credit history or missing documents. Start using Mercado Pago services to build your profile.

Active digital use can improve your standing. Subscribing to Meli+ increases approval chances.

Technical or App-Related Problems

If your application is stuck, try clearing the app cache or updating the app to resolve the issue. Make sure your contact details are accurate.

Outdated apps may block your submission. Always keep your CPF and profile up to date.

Reapplying After Rejection

Denied applications can be fixed with better preparation. Strengthen your credit profile before reapplying.

Verify all documents and data before your next attempt. Use the account regularly to build trust.

Conclusion: Your Guide to a Smart Financial Move

If you’re living in Brazil, this card offers value and control. Apply for Mercado Pago credit card if you want cashback, no annual fee, and app-based convenience.

International users are eligible to apply if they meet the key requirements. It’s a useful tool if you’re active on Mercado Livre or need flexible payment options.

Disclaimer: This article is informational and doesn’t guarantee approval. Rates, terms, and conditions are subject to change; therefore, always consult official sources for the most up-to-date information.