Running a business today means moving fast, staying lean, and having cash available when it counts. That’s where digital credit steps in, especially for entrepreneurs who already use Mercado Pago.

Instead of juggling paperwork or waiting in line at a bank, eligible users can unlock a business loan directly inside the app. It’s built around real-time transaction data, not just traditional credit scores, and delivers funds straight to your wallet in minutes.

For growing companies that need flexible, round-the-clock access to working capital, this kind of financing makes all the difference.

Digital Business Financing

Quick access to capital helps your company stay ahead in fast-moving markets, manage cash flow gaps, and capitalize on new opportunities worldwide.

Mercado Pago’s in-app credit simplifies that process by combining a familiar wallet interface with transparent business-grade lending terms.

What the Mercado Pago Business Loan Offers

Expect a fully digital credit line tailored to your enterprise’s transaction history inside the Mercado Pago ecosystem.

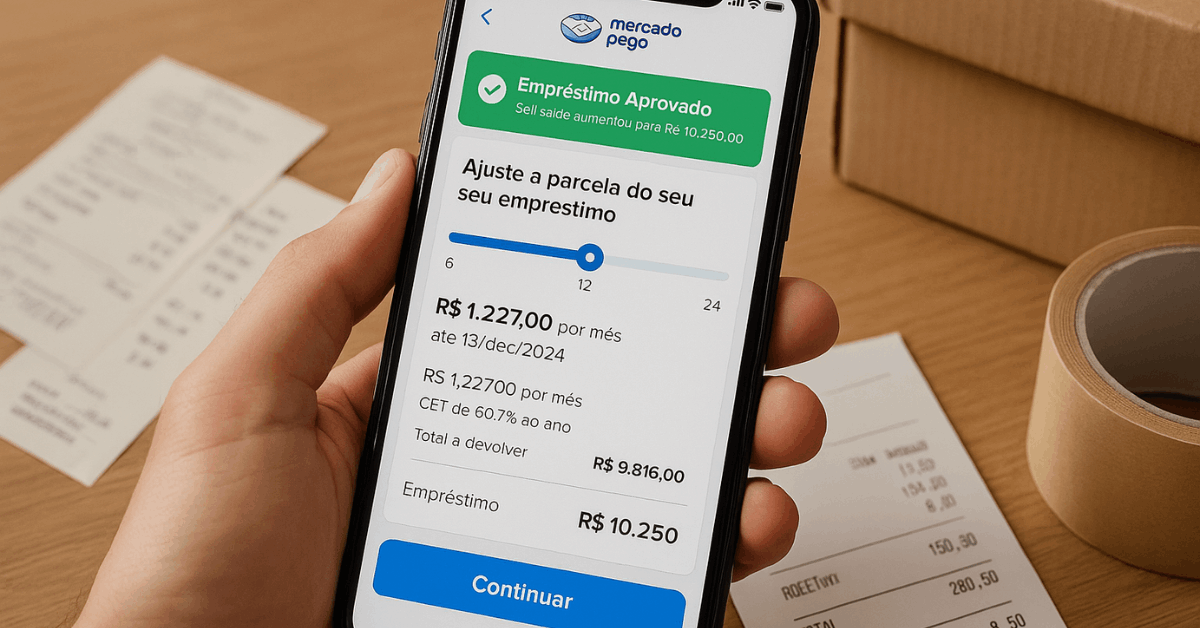

You review a pre-calculated limit, select installment terms, and receive funds directly in your wallet, without needing to deliver physical documents or visit a branch.

Because every step happens online, the service stays available around the clock for entrepreneurs everywhere.

Eligibility: How Mercado Pago Decides Who Qualifies

Mercado Pago relies on proprietary analytics rather than traditional paperwork. Your payment reliability, sales frequency, dispute rate, and wallet activity combine into an internal score that determines loan access.

Companies that send or receive frequent payments, settle invoices on time, and keep their account data up to date tend to unlock higher limits sooner than those with low-volume or irregular accounts.

Users outside Brazil can monitor new regional rollouts. Until the official expansion, only businesses holding a verified Brazilian wallet and a valid tax ID (CPF or CNPJ) will receive formal offers. Here are the core qualification factors:

- Continuous wallet activity that shows steady inflows and outflows

- Positive settlement record with zero unresolved chargebacks

- Verified identity documents and accurate contact information

- Compliance with platform policies and local regulations

- Age eighteen or older for legal representatives

Application Process: Step-by-Step Inside the App

Setting up a request takes under ten minutes and involves no printed contracts. Follow the sequence below when an offer appears on your dashboard.

- Sign in through the Mercado Pago app or desktop site and open “Crédito”.

- Inspect the maximum amount, monthly rate, and available installment options.

- Adjust the requested principal and choose a repayment period between three and twenty-four months.

- Confirm legal entity data, tax ID, and settlement account details.

- Review the full CET (Total Effective Cost) table, then accept the digital agreement.

- Wait a few minutes for automatic approval and wallet funding.

- Allocate the money immediately toward supplier payments, payroll, or stock replenishment.

Funds arrive almost instantly because transfers occur within Mercado Pago’s internal ledger. You may move any portion to an external bank account or leave the balance to cover upcoming merchant fees.

Loan Management Features That Save Time

Your loan dashboard centralizes all the controls you need to stay on track.

- Real-Time Balance View: Check outstanding principal, accrued interest, and next due date in one screen.

- Early Repayment Button: Settle individual installments or pay off the full balance ahead of schedule to automatically unlock interest discounts.

- Push Notifications: Receive reminders three days before each installment and confirmation receipts after payment.

- Flexible Payment Sources: Utilize wallet earnings, linked bank transfers, or seller proceeds to cover installments, thereby reducing friction during busy periods.

Interest Rates, Fees, and Overall Cost

Mercado Pago personalizes pricing according to perceived risk; typical monthly rates fluctuate between 2.9 % and 8.9 %. The system displays every component—interest, credit-opening fee (zero), and CET—before you tap “Confirmar”.

No hidden charges appear later, and you will never incur additional costs to obtain approval. Late installments trigger an automatic penalty percentage defined in the contract, plus daily interest on arrears until the balance returns to good standing.

| Component | What It Means | Typical Range |

| Interest per month | Charged on outstanding principal | 2.9 % – 8.9 % |

| CET | Interest + operational fees | Shown before acceptance |

| Opening fee | One-time issuance cost | 0 |

| Early payoff discount | Interest waived on remaining term | Calculated in real time |

Advantages That Distinguish Mercado Pago Loans

A streamlined interface delivers tangible benefits for entrepreneurs worldwide who already rely on the wallet.

- Digital end-to-end journey eliminates branch visits, phone calls, and scanned forms.

- Instant disbursement supports time-sensitive purchases or emergency payroll.

- Fixed installments simplify cash-flow planning across seasonal cycles.

- Early repayment capability reduces financing costs during profitable months.

- Integration with other wallet tools, Pix transfers, QR payments, or bill settlement, keeps finances in one ecosystem.

Potential Drawbacks You Should Consider

While convenience remains high, consider the following limitations in comparison to alternative lenders.

- Access is restricted to pre-approved accounts; new sellers may wait months for eligibility.

- Interest rates can exceed those of secured bank loans due to the limited collateral available.

- The installment range tops out at twenty-four months, which is shorter than certain traditional credit lines.

- Dedicated relationship managers are not available; support is provided via chat and self-service articles.

Improving Your Chances of Receiving an Offer

Consistent and transparent financial behavior increases algorithmic trust and can lead to an expanded credit limit over time.

- Route daily sales through Mercado Pago instead of third-party gateways.

- Pay marketplace fees, supplier invoices, and utility bills on schedule using wallet balance.

- Resolve buyer disputes quickly to maintain a low complaint ratio.

- Keep tax registrations up to date and upload updated legal documents as required.

- Enable account security measures such as two-factor authentication to strengthen profile credibility.

Additional Services: Insurance and Protection Bundles

Businesses may add optional coverage to safeguard operations.

- Device Theft & Extended Warranty: Protects mobile point-of-sale terminals and smartphones used for transactions.

- Purchase Insurance: Covers lost or damaged goods during shipping to worldwide customers.

- Health and Well-Being Assistance: Provides telemedicine sessions for employees, enhancing workforce resilience.

Activating or canceling any insurance module occurs in the same credit tab, and monthly premiums are displayed alongside loan installments for consolidated tracking.

Managing Repayments Across Borders

Entrepreneurs servicing international clients value predictable settlement flows.

Because Mercado Pago supports cross-border currency conversions, you can collect foreign revenue, convert it to local funds, and apply proceeds to your installment schedule without switching apps.

Eight free Pix withdrawals per month help Brazilian entities optimize their liquidity; each additional withdrawal incurs a modest fee, currently set at R$5.90, which is subject to policy updates.

Customer Support and Issue Resolution

If questions arise, open the Help center inside the app, select “Financing & Loans,” and follow the guided prompts to chat with an agent. Phone hotlines operate daily for urgent cases, and ticket numbers allow real-time status tracking.

Please note that all loan activities, including applications, approvals, and servicing, must be conducted through official Mercado Pago channels. The company never requests deposits via phone or social media.

Global Expansion Outlook

Mercado Pago’s credit model proves scalable because risk assessment hinges on platform data rather than local credit bureau files. As the firm extends wallet services to other Latin American and worldwide markets, similar algorithmic lending could follow. Entrepreneurs based outside Brazil may begin preparing by:

- Building steady transaction histories within their domestic Mercado Pago wallet.

- Linking verified business bank accounts for transparent settlement trails.

- Adhering to marketplace policies to establish an impeccable compliance score.

Early adopters typically receive priority when new credit products launch, resulting in faster approval once regional regulators grant clearance.

Common Questions Answered Quickly

These are the most common questions people ask about Mercado Pago:

- Is collateral required? No, the loan is unsecured and depends solely on account behavior.

- Can multiple loans run simultaneously? Only one active loan is usually allowed; you must repay or refinance before opening another line.

- What happens if an installment is missed? The balance moves into arrears, late interest accrues, and the unpaid amount may limit access to other Mercado Pago services until resolved.

- Can funds go straight to a supplier? Yes, you may transfer any amount from wallet balance to external recipients immediately after deposit.

- Does early payoff affect future limits? Timely or early repayments can boost internal scores and raise future credit ceilings.

Conclusion

Mercado Pago’s business loan offers a pragmatic financing option for merchants who prioritize speed and simplicity over traditional branch-based lending.

Use this guide to prepare your account, monitor for offers, and navigate each step confidently. Review the CET carefully, project cash-flow impact, and only accept terms your business can sustain.

Growth accelerates when capital arrives exactly when needed, and digital credit solutions like Mercado Pago position your operation to seize global opportunities without unnecessary red tape.

Disclaimer

This material provides general information and does not constitute financial advice.

Loan availability, interest rates, and terms vary by jurisdiction, regulatory approval, and individual risk profile. Always read the full contract and local regulations before accepting any credit offer.