We often use credit cards to help us save money or sometimes help us with our balances from other credit lines. This is why a lot of people often use balance transfer cards like the Citi Simplicity Card to help streamline our balances and allow us to pay off our debt.

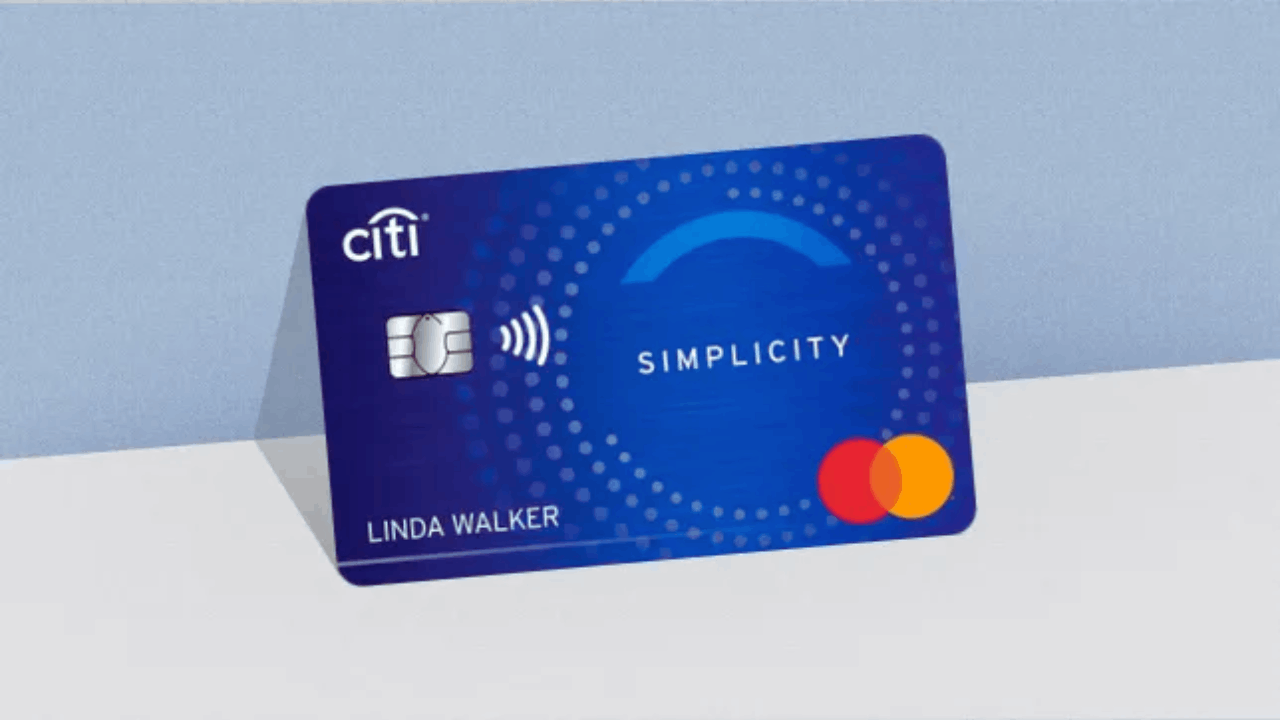

The Citi Simplicity Card is a rather simple credit card used to help you consolidate any high-interest debt from one card to another. It is meant to help you find relief from your credit problems.

If you’re looking into balance transfer cards, the Citi Simplicity Card should be on your list. Check out what’s in store for you and learn how to apply for this credit card with the article below.

Why You Should Choose the Citi Simplicity Card

The Citi Simplicity Card is often chosen for its long intro APR period that helps you with paying off your high-interest debt from other credit cards.

While it may be one of the best features of the card, there are still so many things that you can look forward to with this card.

These are just some of the reasons why you should be looking into the Citi Simplicity Card.

The Longest Intro APR Offer Ever

The Citi Simplicity Card holds the record for having the longest introductory APR offer out of any credit card in the market today. The credit card offers zero percent on balance transfers for the next 21 months.

That is almost 2 years’ worth of having zero interest rates on balance transfers. This gives you an ample amount of time to fix your debt and help raise your credit rating back to where it was.

If you compare it with any other balance transfer credit card in the market, the next one does not even come close to what the Citi Simplicity Card has to offer.

Very Forgiving Interest Rates and Fees

Another great feature to look forward to when you have the Citi Simplicity Card is its very forgiving rates. You have a 19.24% to 29.99% interest rate on both purchases and balance transfers.

And here’s the real secret to having the Citi Simplicity Card, you also receive a 0% intro APR period of 12 months on purchases as well. After that, it will revert to 19.24% to 29.99%.

You also receive a 3% balance transfer fee during the intro period and it will revert to 5% after. There is no annual fee, no late payment fees, and no penalty APR as well.

Account Alerts and Security Features

Cardholders can also expect to receive notifications and account alerts every time they use the card for different transactions.

It is part of the security procedure to protect your card from being used in fraudulent activities. There are also many other security features such as identity theft protection and zero liability on unauthorized charges to secure your card.

You can also use the card to pay using contactless payments to lower the risk of card skimming.

Contact Details

You can also contact them using their customer service hotline – 1-800-347-4934 for further assistance regarding your credit card.

You can call them at any time especially if you need help with your card or if you want to report any unauthorized activity on your card.

You can visit their main headquarters located at 388 Greenwich Street New York, NY 10013 U.S.

Is the Citi Simplicity Card the Right Card For You?

If you’re still wondering if the Citi Simplicity Card is the right credit card for you, you should first check your needs and preferences.

Those who are currently not balancing different credit lines and want to pay off their debt can always choose another credit card with more specific features.

The Citi Simplicity Card might not have the best rewards but it has a very specific purpose for a very specific type of financial situation.

The long-term 0% intro APR is the perfect way for you to pay off your debt and can even help you land your next credit card once you have settled all of your balances.

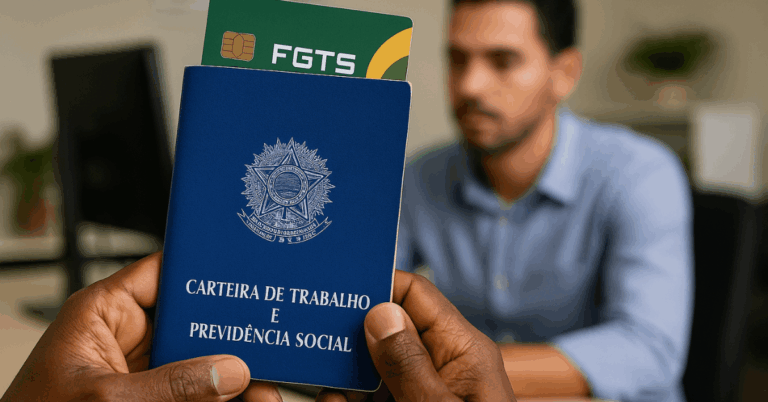

What to Prepare to Apply for the Citi Simplicity Card

To apply for the Citi Simplicity Card, you will need to prepare several details first. You must also be of legal age to apply for the credit card.

Applicants are required to submit several documents such as their bank statements or any documents that provide their total annual income as well as their monthly mortgage or rent payment.

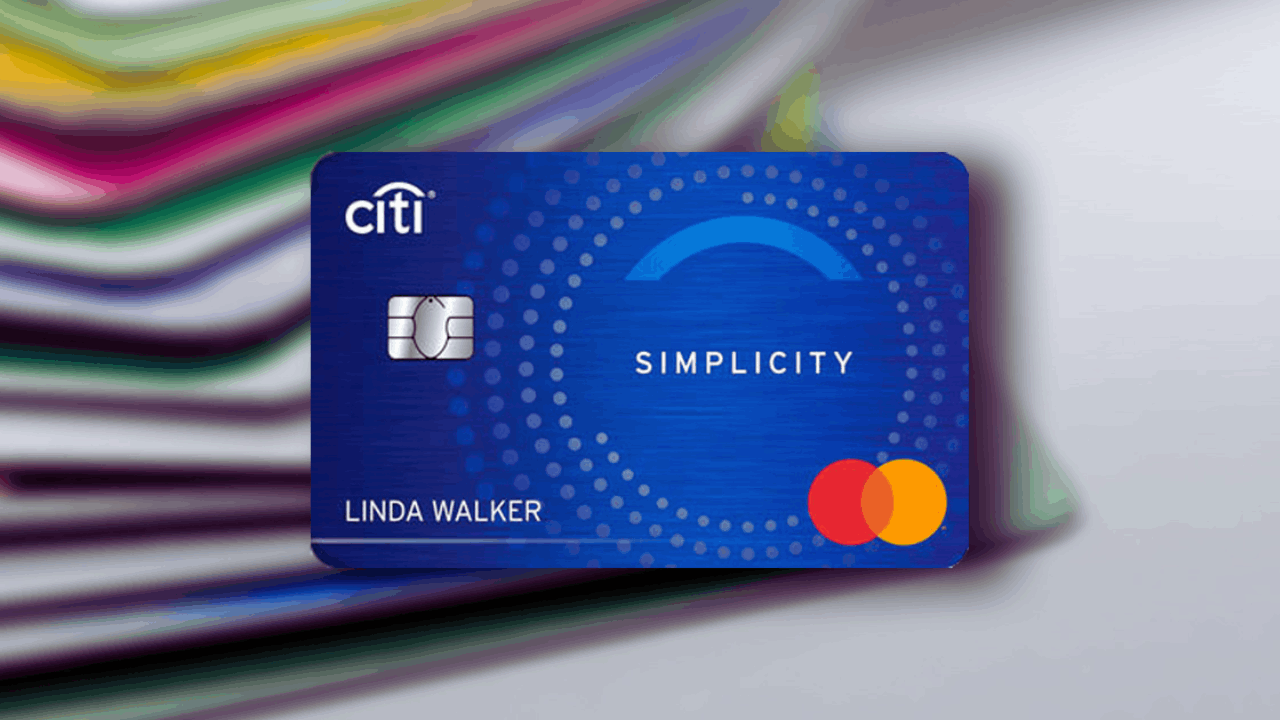

Applying for the Citi Simplicity Card

Applying for the Citi Simplicity Card is designed to be very simple. All you need to do is apply online and get the results within a few minutes.

When applying online, you are also agreeing that you will be receiving your monthly statements electronically.

Here are the steps to apply for the Citi Simplicity Card online.

Applying Through the Official Website

To apply, head over to the official website and choose Citi Simplicity Card then click on Apply. Review the details of the credit card first to see if you missed some information.

Once you click on Apply, fill out the online application form and check the important checkboxes before you submit. You should also review the terms and conditions before you submit your online application.

Online applicants only need to wait for a few minutes before they receive the results. If you don’t get any updates within the hour, you can always call their customer service hotline for more information.

Receiving Your New Citi Simplicity Card

After approval, your card will be mailed to you at the address that you entered during the application. It will take a few days before your card will be delivered to your doorstep.

Once received, follow the instructions mentioned in the letter and you can finally use the card. You will also receive an email regarding updates on the delivery of the card.

Conclusion

If you’re struggling with paying off the balances from other cards, the Citi Simplicity Card offers a very long introductory period to help consolidate your balances. It is one of the best offerings from Citibank that you just can’t afford to pass on. Check out the Citi Simplicity Card and apply for one today!

Note: There are risks involved when applying for and using credit. Consult the bank’s terms and conditions page for more information.