This article will guide you through the steps to apply online for the BNZ Advantage Classic Visa credit card. You’ll know everything needed to finish the process quickly and efficiently.

The focus is on simplifying the application steps for ease of use. By the end, you’ll be ready to apply confidently.

Understanding the BNZ Advantage Classic Visa Credit Card

This section gives you an overview of the key features and benefits of the card. It’s designed to help you decide if this credit card matches your financial needs.

Classic Visa Features

The Classic Visa offers straightforward benefits for everyday spending. It’s designed for users with low fees and essential features without extra frills.

- $20 half-yearly account fee and $6 half-yearly joint/additional card fee

- $500 minimum credit limit

- Supports Google Pay and Apple Pay

- Earn 1 point per $1 spent

- Joint cardholders share 50/50 rewards

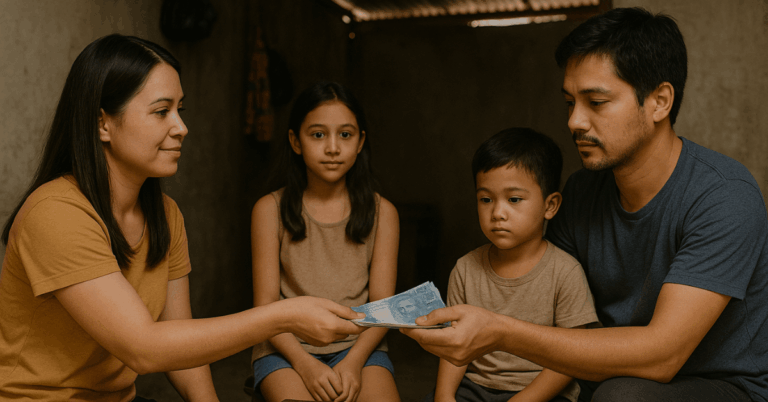

Suitability for Different Financial Needs

This card is ideal for people who want to earn rewards on everyday spending and prefer low fees. If you spend modestly and value simplicity, this card works well.

The low credit limit makes it manageable for new credit card users. If you’re looking for basic features without the need for travel insurance, this card fits the bill.

It’s also good if you already use Apple Pay or Google Pay for transactions. It’s a practical choice for someone with standard credit needs.

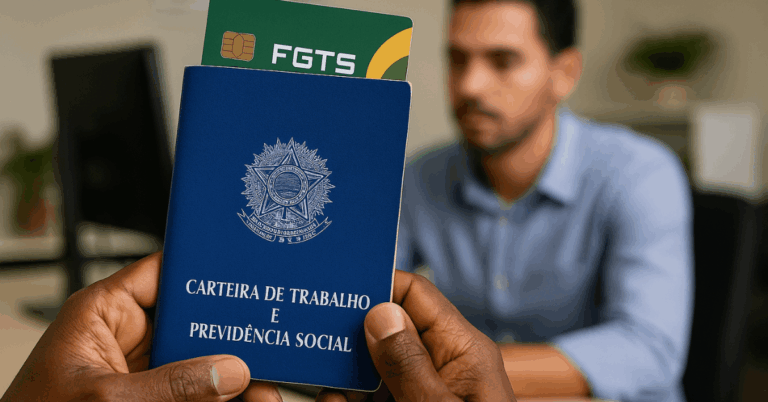

Eligibility Requirements

There are some critical criteria to meet to get this credit card. Make sure you review these points to ensure you’re eligible before applying.

Detailed Criteria for Eligibility

These factors will determine if you qualify for the card. Please go through them before starting your application.

- Must be at least 18 years old

- New Zealand resident or citizen

- Proof of regular income is required

- A reasonable credit history is necessary

- Meet the minimum credit limit requirements

Common Disqualifiers

Some factors might disqualify you from getting the card. Make sure to check these before applying.

- Low or inconsistent income

- Poor or insufficient credit history

- Non-residency or lack of proof of address

- Failing to meet the minimum credit limit

Interest Rates and Fees

This section explains the interest rates and fees associated with the card. Knowing these costs can help you manage your spending better.

Detailed Comparison of Interest Rates

If you don’t pay your balance in full, the purchase interest rate is 20.95% p.a. Cash advances have a higher rate of 22.95% p.a., applied from the transaction date.

If you clear the balance on time, you can enjoy up to 55 interest-free days on purchases. Balance transfers may have different rates depending on current offers.

Paying attention to these rates helps you avoid higher costs. Choose wisely based on your usage to save on interest.

Description of Annual Fees and Other Charges

This card has a half-yearly account fee and a smaller fee for joint cardholders. Late payments come with penalty fees, which can add up if missed often.

Cash advance fees usually apply as a percentage of the amount withdrawn. Balance transfers may also have fees if you move debt from another card.

International purchases may incur foreign exchange fees. Watching out for these charges will help keep your costs down.

Step-By-Step Application Process Online

Here’s a quick guide to help you apply for your credit card online. Follow these steps to complete your application smoothly.

Detailed Guide for Navigating the Website

Follow these steps to apply for the card easily. This will help you avoid confusion and make the process faster.

- Go to the bank’s official website and navigate the credit card section.

- Select the Advantage Classic Visa card option from the list.

- Click “Apply Now” to start the application process.

- Enter your details, including name, contact info, and address.

- Provide income details and financial history as requested.

- Review the application carefully and click “Submit” to complete it.

Tips for a Smooth Application Process

To avoid delays or mistakes, keep these tips in mind when applying.

- Make sure you have all the necessary documents ready before starting.

- Double-check your contact details to ensure accuracy.

- Keep your income information updated for approval.

- Avoid multiple applications for different cards at the same time.

- Use a stable internet connection to prevent application errors.

- Follow up with the bank if you don’t get a confirmation email.

Security Features

This section explains the card’s security features. It’s essential to know how your card stays protected.

Discussion of Security Measures

The card uses chip technology to protect against fraud during transactions. Each transaction is encrypted, making it hard for anyone to steal your details.

It also offers fraud monitoring, which tracks unusual activity and alerts you if anything seems off. Online purchases may require two-factor authentication to add an extra layer of protection.

You can quickly freeze your card if it is lost or stolen through the online banking app. These measures ensure that your card’s security is taken seriously.

Tips for Maintaining Security

Use these tips to keep your card safe when shopping online or traveling abroad.

- Use strong passwords for online banking accounts.

- Enable notifications for every transaction to monitor your spending.

- Avoid public Wi-Fi when accessing your account or making payments.

- Please keep your card details private and avoid sharing them online.

- Check your statements regularly for any suspicious activity.

- Use secure payment gateways when shopping online.

Customer Support

Customer support is available if you need help with your card or have any issues. For lost or stolen cards, call 0800 735 901, or from overseas, dial +64 4 473 5901 (international charges apply).

You can also visit their Auckland office at 80 Queen St, New Zealand, for correspondence. Always contact them promptly if you have any concerns about your account.

Disclaimer: The information about rates and fees is subject to change without notice. Ensure you check the latest updates for accuracy before making decisions.

Conclusion of BNZ Advantage Classic Visa Credit Card – How to Apply Online?

The BNZ Advantage Classic Visa credit card is easy to apply online with clear steps.

It offers good rewards, low fees, and helpful daily-use features. Understanding the interest rates and fees helps you decide wisely.

Follow the steps carefully to avoid delays and enjoy the card’s benefits. Double-check details during the process for a smooth experience.